2018 was a difficult year for pet coke import into India. Petcoke imports peaked in 2016 with 14.59 million metric tons (MMT) being imported into the country but in late 2017, the Supreme Court, banned the usage of pet coke in 4 states bordering the National Capital Region (NCR)—Rajasthan, Haryana, Uttar Pradesh—and Delhi itself, setting in motion close to 12 months of uncertainty around the usage of petcoke by Industry in India.

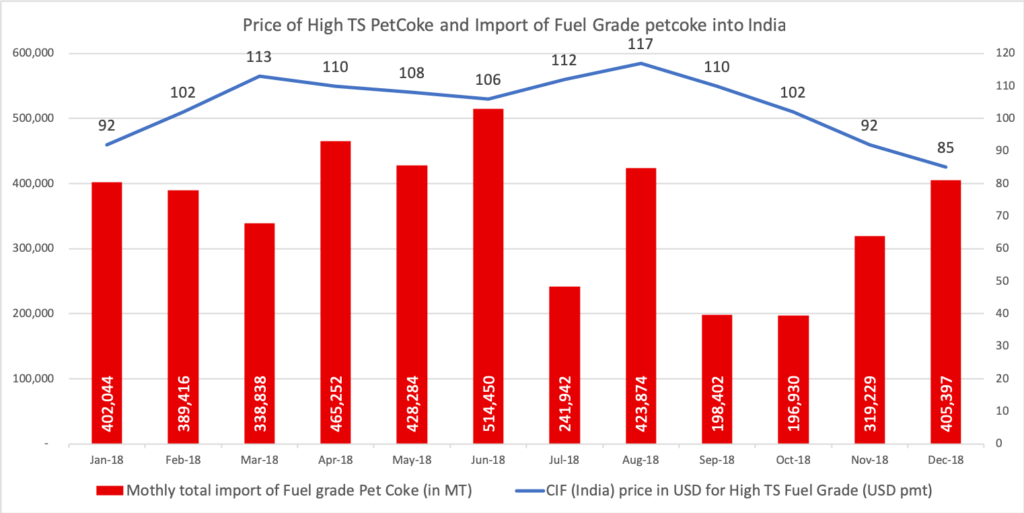

In CY 2017, imports of Pet Coke stood at 12.03 MMTs, against 14.59 MMTs in 2016. In 2018, the pet coke imports contracted 45% to total 6.84 MMT.

In 2016 international petcoke prices hit their all time low where cargoes of 7500 NAR US and Saudi pet coke were available at mid $30 levels and there was gigantic shift to usage of petcoke in India, leading to record import levels.

But with the increased usage across industries and even in dense urban areas such as the National Capital Region came the accompanied emissions and pressure from environmental groups to put some restrictions on the usage and sale of petcoke or its complete ban.

This uncertainty continued into 2018 and it was only in August that the Government and Supreme Court ruled that only certain permitted industries, including cement could use pet coke as a feedstock not as a fuel. The domestic trade of petcoke was restricted to sale to only permitted end users.

These factors affected the import pattern and price of petcoke into India as can be seen from the chart below.

Keywords: #petcoke, #solidfuel, #cement, #petcokeimports, #indiaimports

This article is based on data sourced by Iman Resources

© Iman Reources, Republishing with credits allowed.

Recent Comments